Buying Property in the USA from TripleNet Investors’s Perspective

According to a survey recently published in the Financial Times of London, foreign investors spent $49 billion on US commercial real estate in the second quarter of this year. This is an increase of almost 56% over the second quarter of 2010.

Should you decide to invest in the residential market, which is contrary to TripleNet Investors’s thinking, please read the following:

Throughout most areas of the country, the market has shifted and basic fundamentals matter now, more than ever.

If you are buying for the short term (i.e. to immediately resell either by flipping the deal to another investor wholesale or selling it to a retail buyer) then you need to be buying cheaply enough (preferably at auction), so that when you factor in holding costs, closing costs, management fees, repairs, etc., you will, perhaps, conservatively make a profit.

If, on the other hand, you are buying for the long term, make sure the property being purchased, can afford to pay for itself each and every month and that you have at least two month’s of cash reserves.

Either way, the amount of research, finding the right city, screening tenants and tenants from hell are simply looking for properties and a full time job. The adage in real estate is that if you cannot drive to your property in twenty minutes, do not buy the property! And if you are in South Africa, its longer than twenty minutes! More importantly, you don’t need the hassles and complications in any residential properties when there are alternatives.

Always Remember Two Essential Keys to Investing Intelligently in Today’s Current Real Estate Market:

Key One: Remember Fundamentals – Single family homes offer:

Tenants from Hell

Management Issues

Loaded Pricing

Gurus who make the real money at your expense

The Difference between Purchasing Single Family Homes versus Triple Net Leased Properties and Trust Deed Investing/Hard Money Loans:

The major distinction is that you have a secured investment guaranteed by the creditworthiness of a major corporation that generates your rent each month over a long term period AND the tenant manages the property and pays for maintenance, insurance and taxes. This is a far superior investment than an individual renting on a monthly or annual basis. With a single family home you are always prone to market conditions whereas with a Triple Net Leased property, the rent is stable and in most case, rental increases are built into the lease.

With regard to Trust Deed Investing/Hard Money Loans, this type of investment has almost the same attributes of a Triple Net leased property in that you are loaning money collateralized by real estate with the LTV ration being no higher than 60% to 65% of the appraised value AND most importantly, you do not have to deal with tenants, management and repairs. Read more about Trust Deeds.

Key Two: The Track Record of The Individual You are working with is critical:

Lately there has been an explosion of both extremely inexpensive properties in areas of the States and huckster’s, aka flippers, buying these properties in areas that, let’s say. are problematical especially as it regards socio-economic issues.

Their experience level is absolutely critical as is their integrity, trustworthiness and fair dealings to ensure that you can make a profit.

These individuals MUST disclose and verify their involvement and cost of acquisitions of the property they are trying to sell. If not, walk away -no, runaway! They should disclose their profit margin, chain of title, any kickbacks or referrals they receive on a sale or acquisition of a property.

CASH FLOW is King! Triple Net Leases (NNN) and Trust Deeds are much more secure than residential leased properties.

One of the most consistent and repeatable conversations I hear are about those investors, who though the emotion of greed, seduction by “Real Estate Guru’s”, promises made and their own gullibility, either lose their investment on their initial marginal deal or are forced to feed the negative cash flow.

The rage at the moment is the buying of single family homes in Atlanta, Memphis and Florida. Unfortunately only Arizona and possibly Las Vegas may have any potential due to the phenomenally low prices and the rentals that can be achieved. Many investors forget this cash-flow rule and take marginal deals with little equity upside and even less cash flow just because a motivated seller was willing to deed it to them or the overall price sounded low. Or, they simply do not “get it”. What they fail to understand are that these companies are in the market primarily to make money for themselves, they have purchased the property at a low price, in an area that you would probably not want to live in, spent a few thousand on cosmetic repairs, then doubled the price or raised it to the top of the market pricing, willingly offer a lease for one year and management of the property.

The tenant could be the proverbial “Tenants from Hell” making your life miserable and costing you potential loss of revenue and repair costs that would make a grown man cry.

Get serious. Who is making the money? Certainly not you as you paid top price, spent money on all the offered ancillary services offered by the “guru”. Do you realistically think that you have a secure investment or that the guru is being so generous? The price you paid MAY increase by 2%-3% per year but it could take 10 plus years to make a decent return if you keep it fully leased, are not concerned about functional obsolescence, rising management fees etc. The list goes on. On your own totem pole, you are on the lowest rung. and especially at the mercy of your management company.

Remember that in your local market you need to be an expert. If you are buying for cash, you absolutely need to make sure you really are buying cheap enough (that means 40-60 cents on the dollar, but never pay more than 65% of the “as is value”.) If you are buying on terms (like a subject to deal, or a lease option deal) you need to have the property cash flow to cover the mortgage, HOA, dues, levies, taxes or pass on the property!

Californian sellers and syndicators of property were ensconced in their mantra ” but wait a month and the price will go up! As they say “If it seems to be too good to be true, it probably is”.

At the very least, the syndicator/promoter selling you these wonderful homes should at the very least be offering you a 10 year lease guarantee. Even if you pay a small premium for this insurance, take it every time. If the syndicator/promoter does not offer this option, walk, no run away, fast.

The Difference between Purchasing Single Family Homes versus Trust Deed Investing/Hard Money Loans.

Private Mortgage Lending a.k.a. Trust Deed investing, is an incredible way to build wealth rapidly that most people aren’t even aware exists. By becoming a TripleNet Investors private mortgage lender, it means that you can loan your money with confidence. Because the money is secured by a first or second mortgage, it will not only give you peace of mind, but will also give you the high yield returns that often come only with high financial risk.

Trust Deed investments are high-yield real estate loans that are secured by real estate. These are individual investments in individual properties, as opposed to a loan or pooled fund where your investments is secured by shares of an LLC.

Trust Deed investing is loaning money collateralized by real estate. In other words, they are a privately funded mortgages. The investor loans money to the borrower, and the loan is secured by real property. In many cases, such as the trust deeds originated by TripleNet Investors, the loan is also secured by the borrower’s personal guarantee.

There are two methods used to invest in Deeds of Trust.

Individual Trust Deed Investing: This type of trust deed investing refers to an investor that fully funds a loan on one particular property. As the note is paid, the investor receives their rate of return stated on the note.

Fractionalized Trust Deed Investing: This type of investing refers to a group of investors, each funding a certain percentage of the full amount of the loan. For example, if a borrower required a $500,000 loan, the note may be split up into 10 different investors, each contributing $50,000. This way, each investor would own 10% of the note. All 10 investors would be vested on the recorded security document and they would share in the profits based on percentage of initial contribution.

Triple Net Leased (NNN) Properties a.k.a – “Clipping Coupons” Investing

TripleNet Investors specializes in the building of and acquisition of single tenanted triple net leased facilities.

In a triple-net lease, the tenant manages the property and pays for maintenance, insurance and taxes. The object of the exercise are consistent returns and income generated by buildings with long-term, high-quality, creditworthy tenants, preferably with annual rent increases incorporated into the leases.

Thanks to the aforementioned inherent attributes — triple-net, long-term leases, creditworthy tenants, and potential for long-term capital appreciation — single-tenant commercial properties are growing in importance as a long-term income generator for many commercial real estate investors.

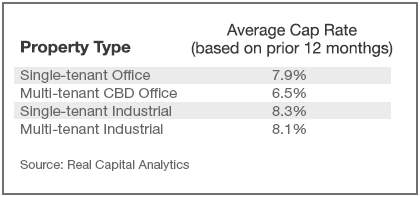

In 12 months through the first quarter of 2011, single-tenant office and industrial properties have been trading at higher spreads to 10-year U.S. Treasuries, and at higher cap rates, than have multi-tenant office and industrial properties.

The average cap rate for single-tenant office during that time was 7.9%, compared with 6.5% for multi-tenant, central business district office assets, according to Real Capital Analytics (RCA). Single-tenant industrial traded at an average cap of 8.3%, compared with 8.1% for multi-tenant properties. (courtesy to Robert Micera)

Visit our FAQ page for more answers to your questions.

1.760.574.7676 | 1.888.907.4822

1.760.574.7676 | 1.888.907.4822 If you have a Smart-Phone download the

If you have a Smart-Phone download the